MANUFACTURED CAPITAL

The Bank’s manufactured capital represents its physical infrastructure which includes the traditional brick and mortar customer contact points, vehicles, IT equipment and furniture as well as its digital infrastructure. The efficient use of manufactured capital enables the Bank to be flexible and responsive to customer needs, allowing it to deliver its products and services to customers effectively. Manufactured capital, particularly digital infrastructure plays a vital role in reducing resource use, allowing human resources to be directed towards strategic, creative and value generating activities. Having identified the crucial role played by manufactured capital in driving customer accessibility, satisfaction and process efficiency, NDB places strategic importance on optimizing and leveraging on its physical and digital infrastructure to drive stakeholder value.

Link to Strategy

Aligned with Transformation 2020, the Bank seeks to strengthen its physical and digital reach, underpinned by the strategic pillars of sharpening business focus and enhancing customer experience.

Challenges in 2017

- Sourcing competitive locations to establish branches in chosen locations

- Rapid technological advancement in financial services sector

- Cyber threats and attacks effecting virtual banking

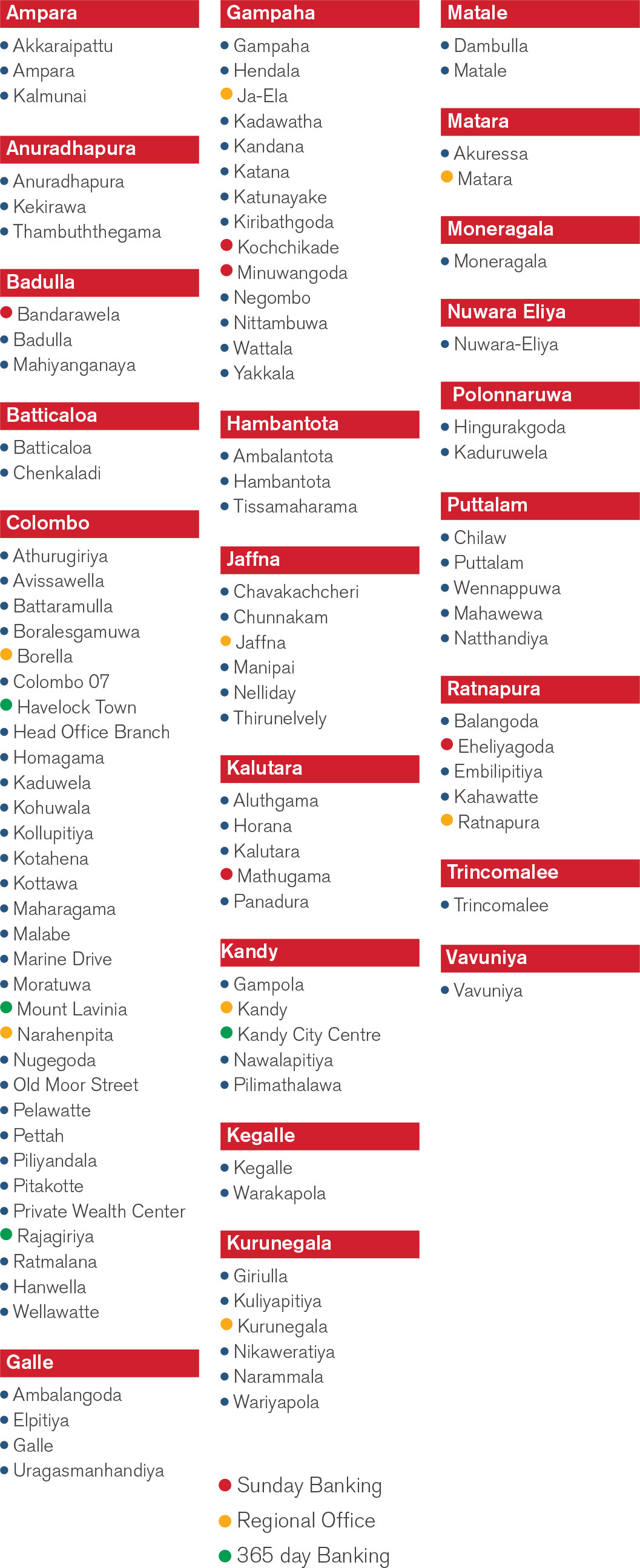

BRANCH NETWORK OF THE BANK

3

New branches opened during the yearat Katana, Kottawa and Private Wealth Centre in Bauddhaloka Mawatha Colombo 04

121

ATMs spread across the country14

Off-site ATMs at convenient locationsPHYSICAL INFRASTRUCTURE

Management Approach

NDB seeks to optimize its branch network with the objectives of enhancing customer accessibility and satisfaction, widening the geographical footprint and increasing its CASA deposit base. The branch reach also plays a vital role in driving the broader social sustainability goal of increasing financial inclusion in economically underserved regions and communities across the island.

Increasing Customer Accessibility

In 2017, NDB added 3 new branches to its network bringing the total count to 107. The new branches were opened in Katana, Kottawa and Colombo 04 in the Western Province. The Colombo 04 branch is NDB's all new iconic Private Wealth Centre branch located in Bauddhaloka Mawatha at the same premises which houses NDB's capital market cluster companies. We also operated 13 fully-fledged branches (12% of our total branch network) with ATMs, in economically disadvantaged areas*, demonstrating our commitment to inclusive banking. These branches are also an effective platform in driving our micro-financing solutions to the grassroots of the economy.

*Northern and Eastern provinces of the country are classified as "economically disadvantaged areas" for the purpose of GRI disclosures.

ATM Network

Our customers are able to perform a variety of transactions conveniently through an island-wide network of 121 ATMs; this represents 107 branch ATMs and 14 off-site ATMs. The offsite ATMs are positioned in strategic locations, helping us to drive our digital proposition in semi-urban and rural communities.

DIGITAL INFRASTRUCTURE

Management Approach

The digital revolution in financial services has presented myriad opportunities to transform the way we do business as well as the way we interact with our customers. Our approach is designed to capitalize on both these aspects as we continue to drive automation, process efficiencies, information security and customer convenience through IT and digital channels. The responsibility for implementing the Bank’s digital strategy lies with the Digital Financial Services Unit which was set up in 2017.

IT-driven Internal Processes

We continued to invest in technology to drive more efficient products and secure processes and during the year the following projects were successfully completed;

-

The introduction of a new balance confirmation system has drastically reduced the operational timelines and increased the service level of the Bank. The system is capable of providing a detailed Balance Confirmation Letter, which includes all banking products used by the respective customer within a minimal period of time.

-

The planned implementation of a Workflow System has opened new avenues for the Bank to re-engineer the existing processes and provide a better customer service within a short span of time. The automation of the Account opening process has reduced a significant level of manual interference and reduced authorization timelines which has enabled the branches to process customer requests with increased productivity.

-

We also streamlined operations by implementing perimeter security by introducing tools such as VMware NSX to accelerate digital transformation for evolving IT environments. It delivers microsegmentation and granular security to facilitate banking systems and enable a more secure data centre.

Digital Financial Services Unit (DFS)

The DFS Unit was set up as a dedicated unit with the objective of strengthening our digital customer proposition to drive customer convenience, accessibility and increased penetration. The digital revolution in financial services has presented numerous opportunities for banks to transform the way they interact with their customers and NDB has taken a proactive and strategic approach towards increasing digital penetration.

The DFS Unit aspires to up lift the Bank in terms of digitization through introducing innovative fintech solutions for superior service delivery.

Mobile Banking

Customer uptake of our Mobile Banking solution has been impressive with the total subscribers increasing by 96% in 2017. During the year 2017, the Bank crossed LKR 4 billion worth of transactions processed through NDB Mobile Banking. We saw increased penetration through a number of highly successful promotional campaigns during the year which encouraged onboarding as well as conducting transactions.

The solution which was launched in February 2016 has raised the bar for mobile banking applications in Sri Lanka by featuring a range of user-friendly payment modes and ‘shake banking’. The solution has already received numerous international awards including the Best Mobile Banking App in Sri Lanka at the Global Banking & Finance Review UK, and the Award for the Best use of Mobile Technology in the Financial Sector at the SLT Zero One Awards for Digital Excellence (please refer pages 20 and 21 for a full list of awards).

Dial Banking

As an extension to the Mobile Banking service, the Bank launched its Dial Banking service, which operates on the USSD platform. This solution is open to customers having basic feature phones through any telco, thereby increasing the potential target customer base.

e-Statements

We continued to encourage migration to e-statements to fulfil the dual objectives of driving customer convenience and reducing paper consumption in line with our environmental objectives. During 2017, more than 28,000 customers were registered for e-statements an increase of 113% compared to the previous year. Several promotions were carried out by the branch and call centre staff to encourage migration to e-statements during the year.

In October 2017, the Call Center reached a milestone of 10,000 customer registrations for e-Statements.

Branchless Banking

The Bank also commenced “branchless banking” using tablets via 24 of our branches, delivering a unique door step service with enhanced convenience to our customers.

Digital Infrastructure in Enhancing the Customer Value Proposition

The effective use of technology and digital infrastructure has enabled us to adopt a multi-channel strategy, serving customers through both conventional brick-and-mortar branches as well as digital solutions such as mobile banking and online platforms. Key achievements in 2017 include,

-

Integration to the Lanka Pay Online Payment Platform (LPOPP) which has enabled the Bank’s customers to pay custom duties through a common portal, driving increased convenience and accessibility

-

The Bank also took steps to connect with several more remittance partners during the year and enable global partners such as Instant Cash Global Money Transfer, WorldRemit Money Transfer and HomeSend.

-

Introduced a global payment network that enables businesses and individuals to send and receive funds all around the world through one simple connection. The IT team implemented the remittance transaction though CEFTS (common electronic funds transfer system) which enables the customers to perform online and real-time remittance transactions.

INVESTMENTS IN MANUFACTURED CAPITAL

Value addition to manufactured capital amounted to LKR 588 million in 2017, representing investments in both physical and digital infrastructure. Investments were directed towards branch openings, enhancing IT systems, strengthening ICT security and digital solutions to customers.

CAPITAL INTERDEPENDENCIES AND TRADE-OFFS

Increased investments in Manufactured Capital and the resultant expansion in customer contact points and stronger digital infrastructure leads to, |

|

Financial Capital |

The initial investments and maintenance associated with manufactured capital will require increased financial resources. However, over the medium to long-term increased process efficiencies and productivity would result in cost savings, larger volumes and wider margins thereby impacting Financial Capital favourably. |

|

Human Capital

|

Automation in routine operational processes can free up employee time for strategic business development efforts, creating a more dynamic and exciting work environment. Over the long-term however it could lead to reductions in headcount. |

|

Social & Relationship Capital

Capital (Customer)

|

Improvements in physical and digital infrastructure have direct implications towards enhancing customer satisfaction, increasing accessibility and improving customer retention. |

|

Natural Capital

|

Expansion of the physical network requires the increased use of natural resources, although this is complemented by a range of energy saving initiatives as well as solutions such as e-statements and mobile banking which contribute towards preserving natural capital. |