FINANCIAL CAPITAL

Our business is rich in financial capital predominantly comprising funds invested by our shareholders. Our capital base is also strengthened by other external fund sources such as subordinated term debts and funds received from credit lines and internal fund sources such as retained profits and revenue reserves. During 2017, we deployed these capitals effectively, in generating sound results to our shareholders, other stakeholders and the nation at large.

Link to Strategy

The Bank’s strategy is directly linked to enhanced financial capital through a number of key performance indicators with clearly set targets to be achieved over the medium term.

Challenges in 2017

- Competition posed by peers in the financial services sector

- Impact of new taxes introduced

- New regulations (Eg: Basel III guidelines)

Priorities for 2018

- Enhancing NIM

- Improving the CASA mix

- Cost management

- Improving market share

FINANCIAL REVIEW

2017 was yet another year of excellent financial performance for the Bank. The Bank recorded accelerated growth in its Balance Sheet supported by impressive growth in customer deposits and loans. Profit growth was higher in comparison to any other financial year, purely from organic and ordinary course of business. The Bank well preserves its asset quality and managed its costs amidst such business expansions.

All of the key business units of the Bank, as well as the group companies made enhanced contribution towards the overall profit attributable to shareholders of the Group.

Following is a full account of the Bank’s overall financial performance as well as the key business units and group companies.

Extracts from the financial statements are presented alongside the discussion where applicable, for ease of reference. The full set of audited financial statements and notes to financial statements are presented on pages 289 to 408.

Key highlights of our performance for the year 2017 are depicted below.

PROFITABILITY GROWTH

37%

NII GROWTH

27%

COST TO INCOME RATIO

45.5%

TOTAL ASSETS GROWTH

15%

ROE IMPROVED

16.27%

REVENUE GROWTH

The Bank’s total operating income was a commendable 23% growth over 2016, contributed by NII growth of 27% and non-interest income growth of 16%.

Given below is the total operating income analysis of the Bank and the Group for the year 2017, in comparison to the previous year.

Total Operating Income

|

Bank |

Group |

||||||

|

2017 |

2016 |

Change |

Change |

2017 |

2016 |

Change |

Change |

|

LKR’000 |

LKR’000 |

LKR’000 |

% |

LKR’000 |

LKR’000 |

LKR’000 |

% |

Net interest income |

10,750,114 |

8,487,312 |

2,262,802 |

27 |

11,086,327 |

8,860,769 |

2,225,558 |

25 |

Interest income |

37,118,699 |

28,618,247 |

8,500,452 |

30 |

37,421,114 |

28,960,606 |

8,460,508 |

29 |

Interest expenses |

26,368,585 |

20,130,935 |

6,237,650 |

31 |

26,334,787 |

20,099,837 |

6,234,950 |

31 |

Non interest income |

5,401,895 |

4,663,489 |

738,406 |

16 |

5,596,645 |

4,816,299 |

780,346 |

16 |

Fee and commission income |

2,520,532 |

2,253,226 |

267,306 |

12 |

3,416,002 |

3,046,132 |

369,870 |

12 |

Net gains / (losses) from trading |

1,063,944 |

982,123 |

81,821 |

8 |

1,063,944 |

982,123 |

81,821 |

8 |

Net gains / (losses) from financial investments |

569,557 |

211,370 |

358,187 |

169 |

733,679 |

440,748 |

292,931 |

66 |

Other operating income |

1,247,862 |

1,216,770 |

31,092 |

3 |

383,020 |

347,296 |

35,724 |

10 |

Total operating income |

16,152,009 |

13,150,801 |

3,001,208 |

23 |

16,682,972 |

13,677,068 |

3,005,904 |

22 |

Interest Income and interest expenses increased by 30% and 31% respectively, over the previous year, primarily due to significant increase in volumes of loans and receivables and customer deposits over the year 2016, coupled with an improved NIM by 36 basis points to reach 3% due to effective re-pricing of the assets and liability portfolios. As a result Net Interest Income for the year of LKR 10.75 billion was an increase of 27% over the previous year. At a Group level the Net Interest Income for the year was LKR 11.1 billion and was a 25% growth over 2016.

Fee and commission from core banking operations increased by 12% to reach LKR 2.5 billion, due to the focused approach in Retail and SME sectors whilst working on the accelerated growth in trade finance and remittance business along with the portfolio growth.

Net gains / (losses) from trading were LKR 1.1 billion for the year 2017 and was a growth of 8% over the previous year. Both forex trading and sales contributed for these gains as the Bank increased its market share in forex profits.

Net gains / (losses) from financial investments was LKR 569 million and have increased by LKR 358 million over the previous year due to the favorable movements in the interest rates experienced during the year and realized gains earned from equity shares classified as “Available for Sale”. At a Group level, the Net gains / (losses) from financial investments was LKR 733 million and was a 66% growth over 2016.

Other Operating income was LKR 1.2 billion and was a modest growth of 3% over the previous year. Other Operating Income comprises of dividends received from group companies, revaluation gains from the Bank’s foreign currency reserves and other miscellaneous income. The Bank received the same quantum of group dividends in the previous year as well. At a Group level, Other Operating Income was LKR 383 million and was a 10% growth over 2016.

IMPAIRMENT CHARGES FOR LOANS AND OTHER LOSSES

The Bank has a comprehensive review process in evaluating the quality of the Bank’s loans and receivables portfolio and the investments portfolio.

Given below are the impairment charges for loans and receivables and other investments during the year, in comparison to the previous year.

Impairment Charges for Loans and Receivables and Other Losses

|

Bank |

Group |

||||||

|

2017 |

2016 |

Change |

Change |

2017 |

2016 |

Change |

Change |

|

LKR’000 |

LKR’000 |

LKR’000 |

% |

LKR’000 |

LKR’000 |

LKR’000 |

% |

Individual impairment |

340,330 |

1,116,072 |

(775,742) |

(70) |

340,330 |

1,116,072 |

(775,742) |

(70) |

Collective impairment |

662,238 |

277,097 |

385,141 |

139 |

662,238 |

277,097 |

385,141 |

139 |

Capital write offs /(recoveries) |

246,157 |

(14,483) |

260,640 |

1,800 |

246,157 |

(14,483) |

260,640 |

1,800 |

Other losses - charges /(write backs) |

9,829 |

(11,733) |

21,562 |

184 |

41,572 |

45,887 |

(4,315) |

(9) |

Total impairment charges for loans and receivables to other customers |

1,258,554 |

1,366,953 |

(108,399) |

(8) |

1,290,297 |

1,424,573 |

(134,276) |

(9) |

The Bank’s individual impairment charges for its loans and receivables portfolio for the year was LKR 340 million and was a reduction of 70% over the year 2016, due to one time provisions made for few individually significant loans and receivables during the previous year.

The Bank’s collective impairment charge of LKR 662 million for the year was an increase of LKR 385 million over the previous year. Whilst the quality of the loans and receivables portfolio increased during the year, the higher collective impairment charge was due to the increase in the loans and receivables portfolio by LKR 45 billion during the year.

Other losses include additional provisions made for an investment in a subsidiary company which is expected to reversed in the future with improved business performance.

LKR million |

2017 |

2016 |

Impairment allowance for loans and receivables to other customers |

4,787 |

6,039 |

Gross loans and receivables |

278,801 |

233,679 |

Percentage of impairment allowance (%) |

1.72 |

2.58 |

COST MANAGEMENT

Cost Management remains a primary focus in executing our business strategies both at the Bank and the Group level.

Given below is a summary of the operating expenses for the year 2017 in comparison to the previous year.

Total Operating Expenses

In LKR million |

Bank |

Group |

||||||

|

2017 |

2016 |

Change |

Change |

2017 |

2016 |

Change |

Change |

|

LKR’000 |

LKR’000 |

LKR’000 |

% |

LKR’000 |

LKR’000 |

LKR’000 |

% |

Personnel expenses |

3,611 |

3,435 |

176 |

5 |

4,025 |

3,793 |

232 |

6 |

Depreciation & amortization |

423 |

434 |

(11) |

(3) |

478 |

491 |

(13) |

(3) |

Office, administration and establishment expenses |

1,477 |

1,285 |

192 |

15 |

1,808 |

1,541 |

267 |

17 |

Others |

1,835 |

1,295 |

540 |

42 |

1,890 |

1,334 |

556 |

42 |

Other expenses |

3,735 |

3,014 |

721 |

24 |

4,176 |

3,366 |

810 |

24 |

Total expenses |

7,346 |

6,449 |

897 |

14 |

8,201 |

7,159 |

1,042 |

15 |

Cost to income ratio (%) |

45.48 |

49.04 |

- |

(7) |

49.16 |

52.34 |

- |

(6) |

Total operating expenses comprising of personnel expenses and other expenses for the Bank was LKR 7.3 billion and was a 14% increase compared to the previous year.

Personnel expenses for the year were LKR 3.6 billion and was a 5% increase over 2016. The increase is primarily due to the annual increments awarded to staff members and increase in head count in line with increase in business activities during the year. Other expenses too increased in tandem, which resulted in increased profitability to the Bank from core banking operations. The year saw 3 new branches and 5 ATMs added on to the network, 2 branch re-locations along with 4 new product launches and one product re-launch. The increase in expenses was well managed amidst such expansions with a largely improved cost to income ratio of 45.48% in 2017 compared to 49.04% for 2016.

At the Group level total operating expenses was LKR 8.2 billion and was an increase of 15% over 2016.

PROFITABILITY

Given below is a summary of the profitability of the Bank and the Group for the year 2017 in comparison to the previous year.

|

Bank |

Group |

||||||

|

2017 |

2016 |

Change |

Change |

2017 |

2016 |

Change |

Change |

|

LKR’000 |

LKR’000 |

LKR’000 |

% |

LKR’000 |

LKR’000 |

LKR’000 |

% |

Profit before tax on financial services |

7,547,420 |

5,335,004 |

2,212,416 |

41 |

7,191,740 |

5,093,546 |

2,098,194 |

41 |

Tax on financial services |

1,547,450 |

1,048,000 |

499,450 |

48 |

1,547,450 |

1,048,000 |

499,450 |

48 |

Taxation |

1,648,341 |

1,116,733 |

531,608 |

48 |

2,211,987 |

1,230,587 |

981,400 |

80 |

Profit after tax |

4,351,629 |

3,170,271 |

1,181,358 |

37 |

3,432,303 |

2,814,959 |

617,344 |

22 |

Profit attributable to shareholders |

4,351,629 |

3,170,271 |

1,181,358 |

37 |

3,489,752 |

2,691,014 |

798,738 |

30 |

The Bank’s Profit before tax on financial services was a growth of 41% in comparison to 2016. This commendable growth was primarily due to improvement in core banking revenue which is a combination of net interest income and non interest income, coupled with cost management initiatives and improved quality of the Bank’s loans and receivables portfolio. Profit After Tax was a growth of 37% which was also due to the reasons enumerated above.

The Group Profit Attributable to its Shareholders (PAS) increased by 30% over 2016, with the contribution of increased core banking operations. However, the contribution from group companies was relatively lesser during the year due to subdued capital market activities.

The PAS was also affected by the cumulative deferred tax provisions made for revaluation gains on investment properties in line with LKAS 12: Income Taxes with the introduction of the New Inland Revenue Act which would be effective from 1 April 2018.

The PAS excluding the cumulative deferred tax provisions was LKR 3.7 billion and was an increase of 38% over 2016.

The overall contribution to PAS from the Bank and the group companies, on a collective basis is analyzed below.

Total Comprehensive Income for the Year

|

Bank |

Group |

||||||

|

2017 |

2016 |

Change |

Change |

2017 |

2016 |

Change |

Change |

|

LKR’000 |

LKR’000 |

LKR’000 |

% |

LKR’000 |

LKR’000 |

LKR’000 |

% |

Profit after tax |

4,351,629 |

3,170,271 |

1,181,358 |

37 |

3,432,303 |

2,814,959 |

617,344 |

22 |

Total other comprehensive income |

355,545 |

(475,083) |

830,628 |

175 |

300,431 |

(496,504) |

796,935 |

161 |

Total comprehensive income for the year |

4,707,174 |

2,695,188 |

2,011,986 |

75 |

3,732,734 |

2,318,455 |

1,414,279 |

61 |

Within Total Comprehensive Income, Other Comprehensive Income increased by LKR 831 million, due to the revaluation gains of from Property, Plant and Equipment and positive gains from mark to market valuation of the Bank’s financial investments portfolio. As a result the Total Comprehensive Income for the year 2017 transferred to Equity was LKR 4.7 billion and was a 75% increase over the previous year. At the Group level the Total Comprehensive Income for the year 2017 was LKR 3.7 billion and was a 61% increase over the previous year.

ASSETS AND LIABILITY ANALYSIS

Given below is a summary of the Assets and Liability position of the Bank and the Group as at the reporting date in comparison to the previous year.

Statement of Financial Position

|

Bank |

Group |

||||||

|

2017 |

2016 |

Change |

Change |

2017 |

2016 |

Change |

Change |

|

LKR’000 |

LKR’000 |

LKR’000 |

% |

LKR’000 |

LKR’000 |

LKR’000 |

% |

Total assets |

383,073,042 |

334,544,735 |

48,528,307 |

15 |

388,645,438 |

340,731,768 |

47,913,670 |

14 |

Loans and receivables to other customers |

274,013,970 |

227,639,844 |

46,374,126 |

20 |

274,063,310 |

227,679,939 |

46,383,371 |

20 |

Investments |

80,657,129 |

80,597,224 |

59,905 |

0 |

83,062,299 |

84,436,804 |

(1,374,505) |

(2) |

Total liabilities |

354,335,207 |

309,799,685 |

44,535,522 |

14 |

354,667,465 |

309,718,472 |

44,948,993 |

15 |

Customer deposits |

273,369,023 |

203,866,547 |

69,502,476 |

34 |

273,041,417 |

203,515,828 |

69,525,589 |

34 |

Debt securities issued and other borrowed funds |

28,107,045 |

59,233,264 |

(31,126,219) |

(53) |

28,107,045 |

59,233,264 |

(31,126,219) |

(53) |

Subordinated term debts |

19,336,855 |

19,446,501 |

(109,646) |

(1) |

19,336,855 |

19,446,501 |

(109,646) |

(1) |

Shareholders’ funds |

28,737,836 |

24,745,050 |

3,992,786 |

16 |

33,012,227 |

29,936,587 |

3,075,640 |

10 |

TOTAL ASSETS

The Bank’s Total Assets was LKR 383 billion as at 31 December 2017 and was a commendable growth of 15% over previous year. The Group Total Assets including the assets of the capital market cluster and the property management company was LKR 389 billion and was a growth of 14% over 2016.

The Total Assets were fortified by the highly satisfactory growth in the loan book by 20% to reach LKR 274 billion. The growth rate surpassed the growth recorded by the industry for 2017.

All of the business segments contributed to the loan book increase, bearing fruits of specific strategies which were rolled out during the year to increase respective market share and volumes. On the retail frontier, housing loans, personal loans, credit cards and leasing propelled the retail loan growth. Loans to the SME and Micro sector also increased. Corporate Banking comprising Commercial Banking and Project & Infrastructure Financing made valuable contribution to the loan growth through their customized corporate banking and cash management solutions.

Investments portfolio of the Bank includes investments maintained primarily for liquidity purposes and remained on par with the previous year, as total deposit mobilization during the year was used to fund the loan book of the Bank.

ASSET QUALITY

The non-performing loan (NPL) ratio of the Bank was 1.83% as of end 2017, a remarkable improvement from 2.63% from end of 2016 and was well below the industry average of 2.5%. The net NPL ratio also improved to 0.94% from 1.01% as at the previous year end. The overall provision coverage on a regulatory basis was 48.57% as compared to 56.85% as at 31 December 2017.

A comprehensive and prudent process is adopted by the Bank from loan origination, approval through disbursement up to timely recovery, which has helped maintain the NPL at below industry average.

Precise diversification of the portfolio and avoidance of over-concentration on any one sector have also helped maintain the quality of the loan portfolio.

Extensive marketing and promotional campaigns spread across the year helped to record balance sheet growth at both asset and liability fronts.

CUSTOMER DEPOSITS

Customer deposits closed at LKR 273 billion, an impressive growth of 34% over the previous year, LKR 69.5 billion in terms of absolute value. Within the Customer deposits portfolio, it is noteworthy note the increase in the CASA base of the Bank by LKR 12 billion during the year, which is a 25% growth over the previous year. The Bank launched a savings planner account titled “NDB Saving Planner” and savings products dedicated to ladies as well as senior citizens, namely “NDB Araliya” and “NDB Achara” respectively. The Bank also re-launched its children’s savings product and introduced a new business proposition dubbed as “NDB Business Class”. All these products, along with the rest of the deposits product suite well contributed towards this deposits growth. As a result the Bank’s funding composition further improved during the year with lesser reliance on institutional borrowings and credit line funding.

The Bank's CASA ratio was 21.2% and compares with 22.7% for the year 2016. The Bank has been able to defend its CASA ratio at these levels, despite a decline in the CASA ratio of the industry, given the current interest rate environment, which induces depositor’s preference to be skewed towards term deposits.

DEBT SECURITIES ISSUED AND OTHER BORROWED FUNDS

Debt securities and other borrowed funds decreased by LKR 31 billion, as part of the restructuring of the funding composition that took place during the year with a view to manage the cost of funding of the Bank. The less reliance on credit lines and other institutional borrowings resulted in the Loans to Deposits ratio (LDR) vastly improving to 102% as at 31 December 2017 from 115% in 2016.

CAPITAL AND LIQUIDITY

The Bank’s Capital Adequacy ratios as at 31 December 2017 are summarized below.

Capital Adequacy

|

Bank |

Group |

||

|

2017 |

2016 |

2017 |

2016 |

Common Equity Tier 1 Capital - LKR million |

24,425 |

NA |

29,859 |

NA |

Total Tier 1 Capital - LKR million |

24,425 |

22,404 |

29,859 |

29,108 |

Total Capital - LKR million |

38,305 |

31,153 |

43,189 |

38,484 |

Common Equity Tier 1 Capital ratio (%) |

8.85 |

NA |

10.49 |

NA |

Total Tier 1 Capital ratio (%) |

8.85 |

9.31 |

10.49 |

11.55 |

Total Capital ratio (%) |

13.89 |

12.95 |

15.18 |

15.27 |

The Bank complied with Basel III regulations which were mandated by the Central Bank of Sri Lanka with effect from 1 July 2017. The Bank’s ratios were well above the minimum regulatory ratios of 7.25% and 11.25% for Tier 1 ratio and Total Capital ratio respectively for the year 2017, with significant growth in the asset base of the Bank, coupled with a significant improvement in profitability.

With the expected growth in assets envisaged in order to achieve medium term plans to become a systemically important Bank, and the impact on impairment provisions expected across the industry with the adoption of SLFRS 9 during the year 2018, the need for capital infusion is a primary strategic focus of the Bank, in the medium term.

The Bank maintains a healthy liquid assets position at all times, whilst ensuring and managing the liquidity levels to support regular business needs. The regulatory Liquid Assets Ratio and the Liquidity Coverage Ratios are given below.

|

Bank |

||

|

2017 |

|

2016 |

Regulatory Liquidity |

|

|

|

Statutory Liquid Assets (LKR’000) |

77,506,348 |

|

67,105,194 |

Statutory Liquid Assets Ratio (Minimum Requirement - 20%) |

|

|

|

Domestic Banking Unit (%) |

22.13 |

|

21.50 |

Off-Shore Banking Unit (%) |

24.01 |

|

22.93 |

Liquidity Coverage Ratio (%) – Rupee (Minimum Requirement - 80%) |

214.35 |

|

142.53 |

Liquidity Coverage Ratio (%) – All Currency (Minimum Requirement - 80%) |

154.50 |

|

125.63 |

PERFORMANCE OF GROUP COMPANIES

The Bank has six subsidiaries (one in Bangladesh), out of which 5 subsidiaries are in the business of capital markets, stock broking, wealth management and investment banking and the other subsidiary company carrying out the business of property management. More details of these subsidiary companies are given on page 19.

The contribution to the Group from the subsidiary companies within the capital market cluster was constrained during the year due to the lower than expected capital market activities experienced during the year. The detailed performance analysis along with the future outlook is given on pages 71 to 79.

KEY PERFORMANCE INDICATORS

The Return on Equity of the Bank improved to 16.27% as at 31 December 2017 from 13.36% as at the previous year. The same ratio for the Group was 11.09% as compared with 9.23% for 2016. The increase in shareholder returns was primarily due to the significant increase in profitability due to improvement in core banking operations of the Bank, there by affirming the Bank’s commitment to maximize profitability to its shareholders. The Earnings Per Share (EPS) also improved to LKR 25.38 for the year and compares with LKR 18.49 for 2016, whilst the Group EPS was LKR 20.35 and compares with LKR 15.69 for 2016.

The Return on Assets also improved to 1.21% as at 31 December 2017 from 0.99% as the previous year end, with improved profitability as a result of efficient leveraging of the Bank’s Balance Sheet.

DIVIDENDS

The Bank paid an interim cash dividend of LKR 2/- per share in November 2017 and has approved a final dividend of LKR 7/- per share for the year 2017, comprising of a cash dividend of LKR 2/- per share and a scrip dividend of LKR 5/- per share. Accordingly the total Dividened Per Share was LKR 9/- for the year 2017. The resulting dividend payout ratio was 35%. The Bank paid a final dividend comprising total Dividend Per Share of LKR 8/- comprising a cash dividend of LKR 2/- per share and a scrip dividend of LKR 6/- per share for the year 2016.

SLFRS 9 IMPLEMENTATION PROGRESS

SLFRS 9 – Financial Instruments, is effective from 1 January 2018 and will replace LKAS 39 – Financial Instruments Recognition and Measurement.

The initial assessment, the gap analysis between the two standards and the revised accounting policy statements on financial assets and financial liabilities were completed during the year 2017 with the approval of the Board of Directors.

The Bank has also performed provisional SLFRS 9 impairment calculations for the first day impact on the adoption of this new standard and has an indication of the potential impact on Equity. Currently the risk modelling methodologies used for impairment computations are being further tested and fine-tuned by the Bank.

The Bank intends to perform a parallel run during the year 2018 to gain a better understanding of the potential effects of the new standard.

Although SLFRS 9 is effective from 1 January 2018, the Institute of Chartered Accountants of Sri Lanka has granted an exemption for the preparation of the interim Financial Statements for 2018 and provides the option to apply SLFRS 9 in the annual financial statements for 2018. Accordingly, the Bank will be in a better position to provide the required disclosures in the ensuing financial year, for which all required steps are being taken.

Please also refer accounting policies for more details on the progress on implementation of SLFRS-9, Financial instruments.

ECONOMIC VALUE ADDED

Economic Performance

The Bank’s performance has value creating impacts on all its stakeholders, including shareholders, employees, customers and the communities we operate in. Our ability to manage the conflicting interests of these stakeholders underpins the sustainability of the Bank’s business. Accordingly, we adopt a triple bottom line approach towards our performance, whereby financial performance is complemented by social sustainability considerations and environmental stewardship.

The Bank creates value through the banking and non-banking activities that it carries out. After the cost of services and impairment charges for loans and receivables, the remaining value is available for distribution to the key stakeholder groups that partner with the Bank. A portion of the value created is retained within the Bank to be invested for expansion and growth.

Economic Value Addition and Distribution

For the year ended December 31 |

2017 |

2016 |

2015 |

2014 |

2013* |

|

LKR million |

LKR million |

LKR million |

LKR million |

LKR million |

Direct Economic Value Generated |

13,903 |

11,516 |

10,893 |

10,398 |

12,560 |

Economic Value Distributed |

|

|

|

|

|

Employees Wages and Benefits |

3,611 |

3,435 |

3,204 |

2,873 |

2,389 |

Payments to providers of capital |

3,920 |

2,909 |

3,655 |

3,356 |

3,317 |

Payments to Government |

3,146 |

2,081 |

2,537 |

2,266 |

1,842 |

Community Investments |

20 |

27 |

8 |

13 |

14 |

|

|

|

|

|

|

Economic Value Retained |

3,206 |

3,065 |

1,488 |

1,890 |

4,998 |

FINANCIAL VALUE ADDED

Financial value defined: Financial Value Addition (FVA) is the excess value created over the required return of the Bank’s investors who comprise shareholders and debenture holders. FVA is a measurement of profit distinct from that of financial profit.

Financial Value Added

For the year ended December 31 |

2017 |

2016 |

2015 |

2014 |

2013* |

|

LKR million |

LKR million |

LKR million |

LKR million |

LKR million |

Invested equity |

28,738 |

24,745 |

22,701 |

22,238 |

19,620 |

Add : Allowance for impairment charges for loans and receivables and other losses |

4,892 |

6,134 |

5,517 |

5,121 |

4,379 |

Total |

33,630 |

30,879 |

28,218 |

27,359 |

23,999 |

Earnings |

4,352 |

3,170 |

3,511 |

3,418 |

7,723 |

Add: Impairment for loans and receivables and other losses |

1,259 |

1,367 |

712 |

566 |

1,238 |

Less: Loan losses written off |

(246) |

14 |

(34) |

(64) |

(76) |

Total |

5,365 |

4,551 |

4,189 |

3,920 |

8,885 |

Cost of equity (Based on 12 months weighted average T-bill rate plus 2% for risk premium) |

12.07% |

11.94% |

8.63% |

10.24% |

12.63% |

Cost of average equity |

3,893 |

3,528 |

2,398 |

2,630 |

2,647 |

Economic value added |

1,471 |

1,023 |

1,791 |

1,291 |

6,238 |

* The one-off equity income of LKR 6,031 million in 2013 is included

COMMERCIAL BANKING

The Commercial Banking Unit’s unique customer value proposition, characterized by innovative and tailor-made product offerings, seamless processes and exceptional relationship management, has enabled it to emerge as a key player in this competitive segment. The Unit specializes in the provision of working capital solutions to large and medium sized corporate entities and benefits from a diverse team of dynamic professionals, a large network of correspondent banks, advanced technological capabilities and efficient processes. The Commercial Banking Unit makes considerable contribution to the Bank’s, profitability and asset base.

OPERATING ENVIRONMENT

The economic and political landscape presented mixed fortunes for the Unit in 2017; moderating economic growth against the backdrop of a weaker agriculture sector and severe competition on rates resulted in a relatively challenging year. The economy also presented opportunities for growth, particularly given the government’s ambitions to transform Sri Lanka to a trading and commercial hub. NDB has always sought to align itself with national growth strategies and we are keen to capitalize on opportunities presented by growing international trade.

STRATEGIC FOCUS

During the year under review, the Unit’s strategy centered on consolidating its portfolio, strengthening fee based income and overall profitability while maintaining portfolio quality. Emphasis was also placed on leveraging our strong relationships to retain customers given the intensely competitive operating landscape.

COMMERCIAL BANKING- HIGHLIGHTS - 2017

|

|

Working capital finance |

Trade services |

|

Cash management |

|

Tradecard services |

Our growth strategy complements the country’s national development agenda and we increased lending to sectors such as tourism, construction/property development, agriculture, manufacturing and business process outsourcing, which we believe are poised for strong medium-term growth. Our portfolio continues to be well diversified, with a balanced industry exposure as well as an equal mix of foreign and local currency loans. We also strengthened our presence in the rural sector, driving financial inclusion through Distributor and Supplier financing.

Ceylon Beverage Can ( Pvt) Limited, is Sri Lanka’s first and only Aluminium beverage cans manufacturer.

Sustaining the quality of the portfolio amidst challenging economic conditions was a key priority during the year and we focused on strengthening underwriting standards and collection mechanisms. Effective monitoring of watch listed customers and the assessment of recoverability on a continuous basis, enabled the Bank to identify early warning signals and take proactive action to address potential delays and delinquencies.

PERFORMANCE

Despite the challenging operating environment, the effective implementation of a focused strategy enabled the Commercial Banking Unit to achieve a profit-after-tax growth of 68% during the year. The Unit’s assets grew by 24% in 2017 supported by the Unit’s focus on the country’s growth sectors, facilitating an operating income growth of 16%. The Unit maintained a fee income: NII ratio of 29 : 71 while astutely managing its net interest margins despite the pressure on funding costs. Ongoing focus on enhancing productivity and operational efficiency enabled the Unit to maintain its cost-to-income ratio as low as 24.6%. Meanwhile the Unit’s liability base increased by 34% during the year. The CASA ratio was maintained at 27.8%, a remarkable achievement given the current economic backdrop and attesting to the strength of our customer relationships.

Credit quality improved during the year, despite stresses on the portfolio arising from the adverse climatic and economic factors. The Unit’s non-performing-loans ratio declined to 0.9% (2016: 2.7%) during the year testament to the stringent credit origination and collection standards that allow the early identification of potential delinquencies.

OUTLOOK

Our expansion strategy for 2018 will continue to reflect key growth sectors in the economy; we see significant potential in tourism, logistics, construction and agriculture-related sectors given government impetus and concessions granted to these sectors by the 2018 Budget. We also see immense potential in off-shore lending and the export sector particularly given the country’s strengthening international relations. Enhancing contributions from non-borrowing fee based income will also be a key priority in 2018 and we hope to achieve this via strengthening our presence in Distributor and Supplier financing and invoice discounting. These services are also expected to enhance our value proposition to customers by providing end-toend business solutions to customers.

The Bank’s competitive edge lies in development banking and we hope to leverage on our reputation, in seeking client acquisition in commercial banking. Synergies with the project financing division is expected to support our client acquisition and allow us to service the entirety of customers' financing requirements.

The Bank's strategy articulates its mediumterm objective of emerging as one of the country’s most significant banks by 2020. The Commercial Banking Unit will be a growth driver in this strategic journey and is expected to play a vital role in the Bank’s overall performance.

We are also encouraged by the opportunities presented by Sri Lanka’s stabilizing macroeconomic fundamentals and increased investor confidence and are well positioned to capitalize on such emerging opportunities.

Cash Management Unit

The Cash Management Unit operates within the Corporate Banking division and serves the transactional banking requirements of the Corporate and SME customers. Its services include, electronic banking, managing financial and institutional relationships, corporate liabilities, a Chinese Desk which caters to the Chinese Business community, and collection and payments of capital market transactions. The Unit’s commitment for excellence was recognized at the Asian Banking & Finance Wholesale Banking Awards 2017, where it received the award for ‘Cash Management Bank of the Year’ for the second year.

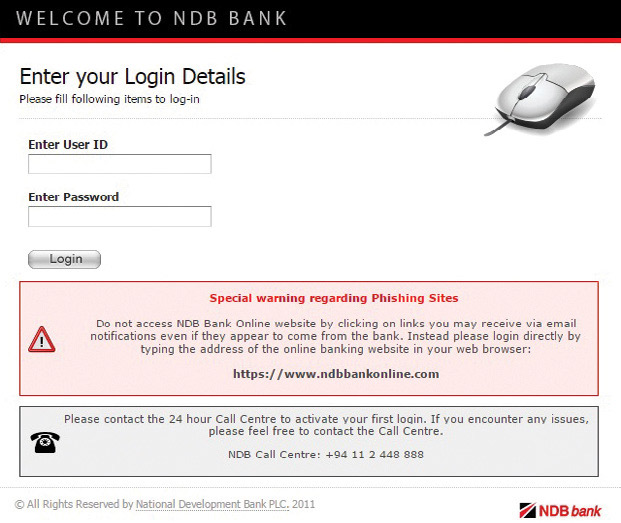

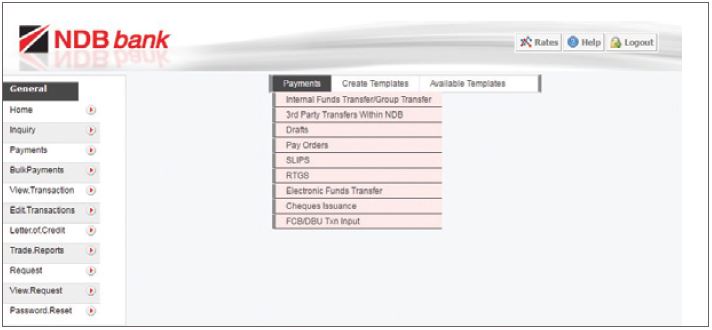

The Unit pursued a strategy of customer acquisition during the year, carrying out aggressive marketing campaigns to penetrate the SME and large local corporate segment. In order to penetrate the latter, the Bank is currently evaluating a new platform which will better serve corporate business both in payment and trade finance. The existing platform will be further strengthened to service the SME business segment of the Bank whilst brick walling the existing transaction customer base.

Increasing customer sophistication and preference for electronic solutions resulted in a dramatic increase in online banking penetration with customer acquisition growing by 80% during the year. In 2016, the online banking platform was further upgraded to provide a better service to Corporate and SME clients. These efforts came to fruition in 2017 with the total online transaction volumes growing by 23% compared to 2016. Total transaction value amounted to LKR 76.5 billion for 2017 with an annual growth rate of 17%. Meanwhile the revenue from Escrow business also recorded strong growth in 2017.

The Bank's Cash Management services provide convenient solutions to its clients, augmented by technology.

The Chinese desk caters exclusively to the banking needs of the Chinese banking community and has positioned itself to capture opportunities in this growth segment. In 2017, The Chinese Desk of the Cash Management Unit was crowned as the ‘Best Overall Local Bank in South Asia for BRI (Belt & Road Initiative) at the Asiamoney New Silk Road Finance Awards ceremony held in Beijing China in September 2017.

The liability arm of the Cash Management unit has grown by 24% in the year 2017, supporting the overall deposits and CASA base of the Bank.

PROJECT AND INFRASTRUCTURE FINANCING

As an organization with its roots in development banking, NDB’s deep industry insights, expertise and long-standing customer relationships have enabled it to build a strong reputation and excellence in project and infrastructure financing. Our understanding of the dynamics of different industries and overseas markets as well as the holistic value proposition which includes provision of advisory services has made NDB's Project & Infrastructure Financing (PIF) Unit, a preferred financial partner for companies seeking longterm financing. The Unit is a frequent recipient of awards and accolades, the most recent being awarded “The Domestic Project Finance Bank of the Year” at the Asian Banking and Finance, Wholesale Banking Awards 2017.

OPERATING ENVIRONMENT IN 2017

The increase in interest rates during the year resulted in an escalation in cost of funds and inserted pressure on the Unit’s Net Interest Margin's (NIM) during the year. However, PIF unit was able to overcome this pressure through pricing and structuring facilities which resulted in improved NIMs compared to previous year. On the other hand, the gradual recommencement of large scale construction and infrastructure projects augured well for the Unit, enabling it to achieve commendable loan growth during the year. The persistently increasing demand for energy and the global call towards reducing dependence on fossil fuels by switching to renewable energy sources have also presented numerous opportunities for environmentally conscious lending.

PROJECT AND INFRASTRUCTURE FINANCING- HIGHLIGHTS - 2017

|

|

Long Term Loans (in both LKR & Foreign Currencies) |

Offering Services as Arranger, Lead bank in Syndications |

|

Islamic Banking Long term Financing Products (in both LKR & Foreign Currencies) |

|

Lease Facilities for Corporates |

|

Securitization of Future Tea Sales |

|

Securitization of Lease & Hire Purchase Receivables |

|

Investments in Listed Rated Debentures |

|

Investments in Listed Preference Shares |

STRATEGIC FOCUS

In line with the Bank’s 3-year strategic plan, the PIF Unit placed emphasis on achieving profitable balance sheet growth by diversifying into specific growth sectors such as construction, finance and power and energy. In 2017, focus was placed on supporting the renewable energy sector- a lucrative sector which will allow us to fulfil both our commercial and environmental sustainability objectives. The Bank strongly believes that it can contribute significantly to environmental sustainability through its lending decisions and during the year we provided funding for four types of renewable energy projects- hydro, solar, waste to energy and bio mass. It is estimated that through lending to renewable energy projects over the years, approximately 390,000 tonnes of CO2 emissions are LKR million 2017 2016 Y-O-Y change (%) Total operating income 1,040 815 28 Pre-tax profit 573 178 221 Profit after tax 338 136 148 Non-performing-loans ratio (%) 0.81 1.54 - Cost to income ratio (%) 35 37 - Loans and investments 63,866 55,905 14 Liabilities 1,739 1,348 29 • Significant lending to renewable energy and infrastructure sectors • Strong performance backed by healthy loan growth • Improved asset quality indicators • Improved Net income eliminated annually which is roughly equivalent to annual CO2 emissions of 83,000 passenger vehicles. Renewable energy projects also eliminate harmful emissions of Sulphur dioxide (SO2) and Nitrogen oxide (NOX). In addition, the Bank also offered concessionary funding for environmentally sustainable initiatives such as effluent treatment facilities and small scale solar power projects. We have also approved a term loan facility to one of the country’s first ever waste to energy projects and approved a diminishing Musharakah co-finance facility to fund a bio mass power project where NDB PIF played a key leading role. As an organization, we are deeply committed to greening our lending operations and as an initial step, we provided foreign training to our employees on green project financing during the year.

The year marked another important milestone for the Unit as it rendered its services as the lead arranger for a syndicated debt issuance with a consortium of four Sri Lankan banks for an off-shore project. The syndicate was arranged to finance the development of a renewable energy project in the East African region promoted by Sri Lankan organizations. Our distinctive capabilities and expertise in offshore lending has afforded a strong platform to capture opportunities in financing Sri Lankan companies which are moving off-shore for energy projects. Overall, the overseas lending activities contributed to 8% of the PIF Unit’s total assets during the year.

NDB's PIF Unit financed the country's first ever wind power project

We continued to play a vital role in supporting the country’s infrastructure development through disbursing the largest term loan facility in the Bank’s history to National Water Supply and Drainage Board. The project is expected to facilitate 100,000 new water supply connections in the Southern Province directly contributing towards uplifting the standard of living for many citizens.

PERFORMANCE

The PIF Unit turned in a year of strong performance, with total operating income and profit after tax increasing by 28% and 148% respectively in 2017, following healthy loan expansion and an overall improvement in credit quality which curtailed impairment losses. The Unit’s loan portfolio grew by 16% during the year and has expanded at a compound annual growth rate of around 32% over the last 4 years which is significantly above the industry growth rate.

The Unit’s lending exposures are well diversified allowing it to reduce concentration risks to a certain degree. The Unit also achieved a substantial improvement in portfolio quality, with a 40% decrease in gross NPLs resulting in gross NPL ratio falling to 0.8% from 1.5% in the year before. This was achieved through close monitoring and followup of stressed accounts, careful selection of projects and continued engagement with our customers. It is commendable that the decline in gross NPLs were achieved despite the strong growth in the loan portfolio during the year.

OUTLOOK

The outlook for the Unit is positive in 2018, with the prevalent cost of funding expected to gradually reduce in view of stabilizing macroeconomic fundamentals as well as the Bank’s own initiatives to reduce its cost of funds. The Unit will pro-actively seek new sectors and business activities for expansion.

As a responsible financial partner, green lending initiatives including renewable energy will continue to be a key focus area for the Bank as it satisfies both our commercial and environmental objectives.

As the country’s financial sector matures, we foresee the intensification of competitive pressures in project financing. We will endeavour to maintain our competitive edge by leveraging on our strong customer relationships, excellent customer service and technical capabilities in handling complex projects. Gathering momentum in providing other financial services such as “Lead Arranger/Lead Bank” which are directly associated with lending activities, we also endeavour to widen our products and services to Sri Lankan companies to carry out their local as well as offshore projects.

RETAIL BANKING, SME AND MICRO FINANCING

Since converting into a commercial banking entity in 2005 from a DFI, NDB has successfully captured market share in this competitive segment by offering innovative solutions through its extensive branch network. The Bank offers an array of deposit and lending products to suit the life style requirements of customers across different stages of their lives. The division together with SME and Micro Units play a vital role in mobilizing deposits required for the Bank’s growth agenda, with retail deposits accounting for 72% of the Bank’s total deposit base.

The total loans of these three Units together contribute to 40% of the Bank’s total loans and receivables.

RETAIL BANKING

OPERATING ENVIRONMENT IN 2017

The relatively tight monetary policy stance adopted by the regulator resulted in an increasing interest rate environment, particularly during the first half of the year. Despite this, private sector credit growth was strong in the first half of the year before decelerating in response to the tighter monetary policy conditions. Meanwhile competition for customer deposits intensified, with depositors seeking high-yielding solutions.

RETAIL BANKING, SME AND MICRO FINANCING HIGHLIGHTS - 2017

Lending Products |

|

Dream Maker Personal loans |

|

Housing Loans |

|

Education Loans |

|

NDB Leasing |

|

NDB Good Life Credit Card |

|

NDB Salary Max Advances |

|

NDB Achara Loans |

|

Deposit Products |

|

Araliya Women’s Savings Account |

|

NDB Children’s Savings Account |

|

NDB Shilpa |

|

NDB Savings Planner |

|

NDB Salary Max Current and Savings Accounts |

|

NDB Achara Savings Accounts |

|

Current Accounts |

|

Foreign Currency Deposits |

|

Fixed Deposits |

|

Other Products |

|

NDB Debit Cards |

|

NDB Travel Pal |

|

Privilege Select – Banking Services to High Network Clients |

|

Safe Deposit Lockers |

|

Remittances |

|

Bancassurance |

STRATEGIC FOCUS

RETAIL DEPOSITS

New product development was a key priority during the year and we launched several innovative, high-yielding deposit products to increase our CASA base and capture market share. Details of these products are summarized below. We conducted a number of exciting competitions amongst staff members to induce sourcing CASA deposits. The Bank also relaunched its minor savings account during the year, offering attractive rewards and a suite of benefits to minor account holders. The response to these new products have been extremely encouraging and contributed towards strengthening the Bank’s CASA base and comfortably meeting the Bank’s deposit targets, along with existing deposit products.

New Retail CASA Deposits Launched During The Year

| Product | Description |

|

NDB Savings Planner (General/Minor) |

This product is a goal – oriented savings solution to encourage savings. It includes savings plans from 2 years to 10 years, ranging from LKR 250,000 to LKR 10 million. The NDB Children's Savings Planner has a guaranteed return up to 9.75% with plans starting from 2 – 10 years |

|

NDB Araliya Savings Product |

A savings product targeted towards women, NDB 'Araliya’ offers a range of benefits including free life insurance and medical insurance for account holder and immediate family members, bonus interest, welcome gifts on the 21st birthday of the account holder and a free NDB Shilpa savings account upon the birth of a child. |

|

NDB Achara |

A lending and investment product for senior citizens (particularly pensioners), this product features longer repayment periods, unsecured lending, convenience, speedy service and life insurance cover for the loan repayment. The product also offers higher rates for fixed deposits to senior citizen account holders. |

|

NDB Children’s Savings Account (Re-launched) |

This product offers attractive gifts to the account holders based on the account balance. A free life insurance premium and permanent disability cover for the parent / guardian, free hospitalization cover for the account holder and cash prizes awarded for excellence at Grade 5 scholarship & GCE O/L examinations are some of key features of this product. |

We conducted a number of innovative deposit campaigns with our existing deposits products over the year. The Avurudu Promo to coincide with the Sinhala and Tamil New Year provided much impetus on improving the Bank’s deposit base. We also rewarded our Shilpa account holders who excelled at the Grade 5 scholarship exams with cash prizes. The “Santa Promo” conducted during December 2017 was yet another iconic deposits promotion, which created much enthusiasm among parents and children across the country.

RETAIL ASSETS

The Retail lending portfolio consists of personal loans, housing loans, education loans, leasing facilities, credit cards and a host of other facilities. The Bank’s personal loan product ‘Dream Maker’, was a game changer allowing customers to obtain financial support based on their needs at different stages of their lives, ranging from education and vehicle purchases to house renovations. A revolving loan facility was also introduced targeting existing customers.

The NDB Home Loan proposition continued to perform well despite the subdued economic conditions. We enhanced the efficiency of our documentation processes to ensure that housing loans are approved in 3 days, providing a source of competitive edge in the highly competitive housing loan segment. The product was further strengthened through the addition of a value-added-service which involves document support such as title search. The Bank also continued to reinforce its presence in the condominium market by entering into new tripartite agreements with developers of new properties in Colombo and its suburbs.

NDB’s credit card offering, NDB Good Life had an eventful year in 2017 with a number of exciting credit card offers and promotions. The card offered attractive seasonal discounts at a host of retail outlets, restaurants, hotels and online purchases. Credit card balance transfer promotion was also another attractive initiative carried out during the year.

The hype created by all these activities led to significant increase in credit card volumes and the customer base.

OUR RETAIL FOOTPRINT

The branch network plays an integral role in delivering our retail banking offerings to a broad base of individuals at all stages of life. During the year we added 3 new branches to our network, taking the total reach to 107 (refer Manufactured Capital on page 88 for further information). The Bank persistently strives to partner customers in the achievement of their lifelong ambitions through providing a range of services that are accessible through the branch network.

Having identified customers’ increasing demand for multi-channel banking and higher accessibility, we continued to drive our digital proposition- primarily through mobile and internet banking.

PRIVILEGE SELECT

NDB Privilege Select is the Bank’s iconic private banking offering to its high net worth retail client base. Privilege Select is one of the leading and most popular private banking offerings within the Sri Lankan banking industry. This proposition is designed to provide exceptional individual attention to the high net worth clientele, and is complete with unique financial offerings that include a range of novel wealth management and wealth creation tools.

This proposition features a total financial services package along with exclusive benefits that complements the lifestyles of the high net worth clients. Our dedicated and versatile Privilege relationship managers extend customized services to our clientele in helping them make quality and timely decisions on their investments, augmented by privacy and convenience.

As of end 2017, we functioned three dedicated Privilege centres at Colombo 07, Havelock Town and Mount Lavinia. Furthermore, our Privilege services are offered to the clientele through our retail network spread across the country. As such, their needs are taken care of, wherever they may be. During the year, the Bank also hosted networking functions for Privilege clients in Colombo and the suburbs.

Privilege Select services are planned to expand their services to a wider range of clients through an expanded network of Privilege Select Centres in 2018, with enhanced offerings.

PERFORMANCE

Please refer page 65 for a full performance review of Retail, SME & Micro Financing Units.

OUTLOOK

We are optimistic about the opportunities presented by the anticipated stabilization of the country’s macro-economic fundamentals and resultant improvements in customer sentiments. Our efforts to enhance customer convenience and offer a speedy service through re-engineering our lending processes and account opening processes will deliver greater results in 2018 and beyond. We will focus on increasing our CASA base through incentives given to our team members. We will also leverage the maximum benefits of the innovative and dynamic lifestyle products we have on offer to reach out to a broad base of retail clients through our robust branch network in helping them prosper and develop as individuals and families. In doing so, we intend to further affirm our footprint as a competitive retail oriented commercial banking entity in the country.

SME BANKING

Sri Lanka’s SME sector has long-since been recognized as the backbone of the economy and its engine of growth. We believe that the expansion of the SME Sector can drive substantial socioeconomic progress and we are committed towards facilitating this growth through a dedicated ‘Business Banking’ unit targeting the SME Sector. The Bank’s inherent strengths in development banking has afforded it an ideal platform to support the country’s SMEs and we offer a holistic value proposition featuring innovative and diverse products, an extensive branch reach, advisory services and a deep understanding of industry dynamics.

OPERATING ENVIRONMENT IN 2017

2017 was a challenging year for the country’s SME Sector, primarily due to the adverse weather conditions which were experienced in forms of droughts as well as floods, having a direct impact on the agriculture sector. Spillover effects were also felt in related subsectors of the economy, which resulted in a moderation of overall economic growth. These trends inserted pressure on the repayment capacity of SME borrowers impacting the quality of the portfolio.

STRATEGIC FOCUS

In line with its strategic focus on emerging as a significant and systemically important bank by 2020, NDB set up a dedicated unit for SMEs and middle markets through which exclusive attention is given to the SME Sector with dedicated teams driving the small and middle market propositions. This restructuring has enabled the Bank to expand its reach, enhance customer service through efficient processes and optimize relationships through pursuing cross-sell opportunities. The SME unit has also been positioned to play an important role in enhancing the Bank's CASA base.

During 2017, the Bank also introduced a new current account proposition titled as NDB Business Class. The product features a bundle of benefits such as preferential rates on Letter of Credit, Collection Bills, Telegraphic Transfers, etc. and fee waive offs for services such as cheque books.

This proposition is augmented by dedicated relationship banking for SME and Middle market customers in supporting them to grow their business.

Lending Products |

||

• |

Long Term Loans |

|

• |

Short Term Loans |

|

|

Supplier Finance |

|

|

Export Finance |

|

|

Post Import Finance |

|

|

Packing Credit |

|

|

Distributor Finance |

|

|

Revolving Working Capital Loans |

|

|

Tea Manufacture Working Capital Finance |

|

|

Current Account Based Products |

|

• |

Cheque Warehousing |

|

• |

Guarantee Facilities |

|

• |

Letters of Credit |

|

Deposit Products |

||

• |

Savings Products |

|

• |

Time Deposits |

|

• |

NDB Business Class – Current Account |

|

PERFORMANCE

In 2017, we widened the scope of our operations by providing seed capital for start-ups and the diversification of existing businesses, in addition to business expansion. The optimum use of several low-cost credit lines such as ADB’s SMELoC and SMILE III enabled the Bank to disburse funds at attractive rates and we leveraged on our geographical reach to increase lending outside the Western Province. As a responsible financier, strategic focus was also placed on increasing our exposure to green financing initiatives. In line with the Bank’s overall strategic agenda we have continued to focus on cash-flow based lending in growth sectors of the economy such as tourism, manufacturing, agriculture and services. The Bank adopted industry focused approach, enabling it to capture emerging opportunities in growth sectors.

We maintain a high level of customer engagement with our SME clientele, facilitated through business visits, customer forums and seminars. Engagement also occurs in collaboration with industry forums, chambers and other regional bodies which is an effective platform to pursue new business. We also focused on strengthening our delivery efficiency and customer service by upskilling our SME team through targeted training programmes.

OUTLOOK

The SME Sector is anticipated to play a significant role in achieving the broader goals set under the Bank’s strategic plan for 2020. The Sector’s growth strategy will be underpinned by effective customer segmentation which will enable targeted marketing and customized solutions for individual segments. The anticipated improvement in investor sentiments coupled with stabilizing macro-economic fundamentals will augur well for the SME Sector and we are positioned to capitalize on these opportunities.

We will continue to empower this sector using our expertise across a broad spectrum of sectors which in turn will propel the country's economy ahead.

We provide vital financial support to the tea industry, through our tailor-made tea manufacturer working capital financing solutions

Rice mills are also beneficiaries of our endeavours to strengthen the SME sector

MICRO FINANCING

Since commencing micro financing in 2010, the Bank has directly contributed towards the empowerment and socio-economic progress of thousands of needy individuals across the country. Our success in this segment is underpinned by a holistic value proposition extending beyond mere financial support to include customer education and training initiatives targeted towards nurturing financially disciplined customers. Micro finance has been an ideal platform via which we integrate our social sustainability objectives to our business operations.

OPERATING ENVIRONMENT IN 2017

Promoting financial inclusion through micro financing is a key thrust for the Government as it is an effective tool in alleviating poverty and empowering the economically and socially vulnerable. Accordingly, the Government has placed policy emphasis on strengthening the sector and enacted the Microfinance Act No. 6 of 2016 as a regulatory framework to govern micro finance institutions and set up a Department of Supervision of Microfinance Institutions in the CBSL. In 2017, the operating environment presented several challenges to the sector. Demand remained strong although the weakening of the agriculture sector and the increase in interest rates pressured repayment ability to a certain extent.

STRATEGIC FOCUS

In 2017, strategic focus was placed on identifying new avenues for lending, widening the scope and coverage of our financial literacy initiatives and maintaining the credit quality of the portfolio through effective risk mitigation mechanisms.

|

|

Financing for Community Based Organizations |

Cluster-based lending |

|

Agriculture and Commercial Cultivation Loans |

|

Fisheries |

|

Animal Husbandry Loans |

|

Self Employment Loans |

|

Personal Loans for Factory Workers |

Financial Support: Through the Divi Aruna initiative, we fund numerous needs including business start-ups, expansions, asset building, working capital requirements and agriculture. A considerable number of our micro finance clientele comprise women, as the financial empowerment of women has been directly linked to the socio-economic progress of families. We disburse funding through community based organizations and cluster based lending targeting specific growth industries such as agriculture and exports.

Supporting the Cinnamon Industry: During the year, we engaged in an initiative aimed at supporting the country’s cinnamon industry, which often lacks the capacity and technical knowledge to meet export standards. The cinnamon industry has substantial export potential and we sought to strengthen technical knowledge among cinnamon growers by conducting 4 programmes in partnership with the Export Agriculture Department. The programmes were open to both our customers and external cinnamon growers and provided comprehensive training on how to cultivate high quality cinnamon products, value added products and best practices in processing.

Cinnamon drink, a value added product made from raw cinnamon

Empowering Women: Conducted as an ongoing initiative, these structured programmes are carried out with the objective of equipping female entrepreneurs with the basic business management skills and financial discipline required to successfully manage their ventures. The program is open to both existing women SME & Micro customers of the Bank and non-customer women entrepreneurs. The contents of the workshops are carefully structured to impart essential business knowledge while uplifting motivation and morale.

During the year, we conducted 4 such programmes in Colombo, Balangoda, Matale and Minuwangoda with a total participant base exceeding 400. These programmes have directly contributed towards ensuring the sustainability and long-term success of the participants’ business ventures. It is generally believed that the financial empowerment of women results in socio-economic progress of the family, as women tend to save more and invest in avenues benefitting the family, such as education, health and housing. We are committed to facilitating this progress and intend to further widen the scope and coverage of this initiative going forward.

Divi Aruna : NDB’s strength to start–up businesses

Financial Literacy: NDB’s ongoing financial literacy programmes are aimed towards strengthening financial discipline among our clients by providing guidance on investments, savings as well as basic training on accounting, book keeping and budgeting. Since our Micro Finance clientele primarily represent individuals who are new comers to the banking industry, these programmes have been vital in improving financial management and discipline.

In 2017, we organized 12 large scale financial literacy programmes with the participation of over 1,200 individuals. Of these, programmes conducted in Monaragala, Vavuniya and Kilinochchi were conducted in collaboration with the Export Development Board. We also conducted programmes for community leaders of the Homagama Secretariat Division in partnership with the Divisional Secretariat office. Over 50 community leaders participated in this programme and we hope to extend the training to end-users through these societies.

The Bank’s endeavours in promoting financial literacy

PERFORMANCE

The Micro Financing Unit achieved strong portfolio growth with outstanding advances increasing by 36% during the year, to close at LKR 445 million. The Bank’s Micro Finance portfolio is diverse in terms of its industry exposure, with agriculture and retail being the dominant sectors.

As Micro Financing by nature records relatively higher non performing loan levels, the Bank closely monitors its portfolio quality and takes proactive measures to manage the NPLs. The portfolio is also diversified in its regional exposure, with over 75% of the portfolio originating outside of the Western Province, attesting to our commitment to regional growth.

OUTLOOK

Having identified the strong potential for entrepreneurial activities at grass root level, the Bank intends to widen the scope of its micro financing operations to promote financial inclusivity. We hope to reach out to a diverse range of micro-segments, including farmers venturing into organic paddy cultivation, floriculturists, and small scale street food vendors, etc. We hope to further expand our value proposition beyond financial support through offering technical and entrepreneurial support, access to market linkages and guidance on improving product quality and productivity. These factors are anticipated to strengthen customer loyalty and increase customer retention while strengthening the Bank’s brand name in this segment.

MICRO FINANCE CUSTOMER TESTIMONIALS

Mr. Milan Perera's inspiring story is one of hard work, determination and innovative thinking. Milan founded and manages Colombo’s only sea turtle conservation project, the aim of which is to conserve the local nesting sites and care for disabled sea turtles. He operates a sanctuary through which eggs are rescued and hatched.

“I started with just two plastic tanks and after receiving the 1st loan from NDB, I built 3 large cement tanks. Every year I release around 10,000 turtles to the sea and care for around 20 disabled turtles."

I am the only licensed person to do so in the Colombo district. When my centre gained popularity, school and university students visited it for educational purposes. NDB supported me once again in the development of infrastructure facilities. Using a loan of LKR 1 million, I built a hut for visitors and 2 additional tanks; this loan was immensely valuable to me as it was at a time in which two tanks were destroyed due to sea erosion. From the start, NDB has partnered with me in my progress.

Mrs. Kahaduwa ventured into textile business in a small scale. She obtained a Divi Aruna micro finance facility from NDB and subsequently expanded her operations to include flag making. This proved successful and she now employs 2 workers. With her 2nd loan of LKR 50,000/- she further expanded the flag business to emerge as a market leader in Colombo’s wholesale market. Next she sought to set up a shop in Colombo and with her 3rd loan from NDB she acquired a textile shop and further expanded her business. She currently provides employment to 7 individuals.

After facing many difficulties in my rice mill, I was keen to start a pineapple cultivation. However, obtaining the initial capital was a huge challenge for me and I am immensely grateful that NDB placed their trust in me and provided a LKR 500,000/- loan to start my cultivation. The cultivation was successful and every year I expanded the quantity of production. With my 3rd loan of LKR 1 million I was able to expand my cultivation to 4 acres and currently I generate a monthly income of over LKR 400,000 /-.

PERFORMANCE

(RETAIL, SME AND MICRO SEGMENTS)

The segment recorded exceptional growth during the year with combined profit after tax increasing by 95%. The introduction of several innovative products, both in the retail and SME lines allowed broad based expansion in the total loans and receivables portfolio by 15%.

The moderating economic conditions led to an influx of NPLs, although the segment’s gross NPL ratio remained relatively healthy at 3.2%.

The retail sector’s deposit portfolio inclusive of SME and micro segment deposits expanded by 32%, a reflection of the Bank’s strong deposit franchise and ability to mobilize deposits amidst intensifying competition.

Ongoing focus on process efficiencies and productivity improvements enabled the segment to manage its operating costs during the year, despite 50% of the branch network being relatively new, having opened for business in the last five years.

REFINANCE OPERATIONS

Refinance schemes are a highly efficient way to inject funding to preferential economic activities that have been earmarked for growth. The country’s financial sector is a catalyst in channelling funds towards these sectors due to their geographical reach, ground-level presence and industry expertise. NDB is proud to have been selected as a Participatory Financial Institution to partner the Government and multi-lateral agencies in disbursing funds towards selected sectors.

STRATEGIC FOCUS

NDB Refinance is an active partner to the Government in channelling credit lines from multilateral donor agencies to end-users. In 2017, NDB has disbursed funding from agencies such as Asian Development Bank (ADB) and Japan International Co operation Agency (JICA).

The Bank has also disbursed facilities from two credit schemes launched by the GOSL namely Swashakthi and Saubhagya with limited funding.

NDB continued to work with the GOSL and agencies in disbursing funds towards the micro, SME, Middle market and Corporate sectors. We placed our effort on stretching the benefits across as many beneficiaries as possible within the eligibility criteria framework stipulated by the conditions attached to the respective funding lines. Brief descriptions of the refinance schemes that we engaged in, are as follows;

SMILE 111 Revolving

This LKR 9.0 billion facility was extended by the Ministry of Industry & Commerce and NDB has withdrawn LKR1.6 billion to date, representing 17.% of the total facility. The Bank is the largest withdrawer of this line among the participating financial institutions. We granted approximately 200 number of facilities with these funds to date.

USD 100 million Small & Medium Enterprises

Line of Credit (SMELoC)

The credit line is sponsored by the Asian

Development Bank and was launched in

2016 by the Project Management Unit

established under the Ministry of Finance

& Planning. Funds are channelled towards

Small & Medium Enterprises in Sri Lanka with

special focus on boosting entrepreneurship

ventures led by women and businesses startups

with no previous business borrowing foot

prints. The facility is also targeted towards

strengthening financial inclusion in regions

outside the Colombo District.

This credit line is partnered by 10 financial institutions including NDB, and we granted 68 new facilities comprising 22 facilities to women-led enterprises and 18 facilities to first time borrowers for start-up projects. NDB is the highest withdrawer from the USD 100 million Credit Line.

Swashakthi Loan Scheme.

CBSL launched the credit scheme following

a cabinet decision to create 25,000 new

employment opportunities. The objective of

this scheme is to provide financial backing to

youths with innovative business propositions

who do not have the capital to fund their

ventures.

Refinancing Loan Schemes to

Encourage Environmental and Social

Sustainability Objectives

Environmental sustainability has emerged as a

key priority for governments and organizations

around the world, as the impacts of climate

change are felt increasing frequently. The

Financial Sector has identified the crucial

importance of aligning business practices

and standards to environmental objectives

and has sought to provide concessionary

funding to encourage investments targeted

towards meeting national environmental

goals. During the year NDB continued to

grant environmental loans at concessionary

rates under the green financing scheme.

The primary objective of the credit scheme

is to assist industrial enterprises by providing

financial assistance for investments to

mitigate environmental pollution and ultimately

ensure compliance to national environmental

standards of the country.

NDB joined the E Friends Revolving II project sponsored by Japan Bank for International Corporation through the Ministry of Industry of Commerce in 2017

OUTLOOK

Strengthening the country’s SME and micro enterprises is a key priority for the Government and concessionary funding lines has been identified as an effective and efficient mechanism to channel funding towards such entrepreneurs. Obtaining low-cost funding for investments plays a key role in ensuring the sustainability of these ventures and refinancing plays a pivotal role in supporting this requirement. In aligning itself with national development goals, The Bank is well positioned to enhance its contributions through tapping into more concessionary funding schemes in 2018. These include the following;

E-friends Revolving 11

The Bank recently executed a subsidiary loan

agreement with the Ministry of Industries and

Commerce to partner environmentally friendly

loan schemes.

Asian Development Bank Roof Top

Solar Loan Scheme

Open to both domestic and business sectors,

this credit line would aid the installation of

photovoltaic solar power generating solutions

installed on existing permanent roof top

structures.

Additional Funding Under Asian

Development Bank Sponsored Small &

Medium Enterprises Line of Credit.

This is an extension of the USD 100 million

Credit Line completed in the year 2017. On

the success of the USD 100 million credit line

GOSL is negotiating with the ADB to further

assist women-led business ventures and startups

for entrepreneurs who have not tapped

the formal banking sector.

ISLAMIC BANKING

The Bank ventured into Islamic Banking with the launch of ‘Shareek’ in August 2014. The Unit has seen impressive growth in recent years, underpinned by its competitive returns and highly experienced staff supervised by eminent Shariah scholars.

STRATEGIC FOCUS

The Bank offers a range of Shariah-compliant products including Ijarah, Murabahah, Diminishing Musharakah, Mudarabah and Wakala for the retail and business sectors. The Unit benefits from the Bank’s extensive regional footprint and presence across all segments, allowing it to capitalize on emerging opportunities.

NDB Shareek’s excellence was recognized at the Islamic Finance Forum of South Asia 2017 where it won the Bronze Award for the Islamic Banking Window/Unit of the year 2016 and the Silver Award for the Turnaround Entity of 2016. It is noteworthy that the Bank emerged victorious competing with established banks from Maldives, India, Pakistan, Bangladesh and Sri Lanka including leading Banks such as Meezan Bank – Pakistan and Standard Chartered Bank – Bangladesh. NDB “Shareek” is fully equipped and is led by a team that is both well trained as well as experienced in the area of Islamic banking which is supervised by eminent Sharia scholars.

PERFORMANCE

The Unit achieved a stellar performance during the year, with an asset and profit growth of 111% and 53% respectively. The deposits base grew by 62%. The Unit also maintains a high-quality portfolio, with a gross NPL ratio of below 0.08%. Asset growth was supported by continued engagement with the other business lines as well as customer awareness and marketing campaigns carried out in geographies with high potential for growth.

ISLAMIC FINANCE - HIGHLIGHTS - 2017

Lending Products |

|

Project financing |

|

Working capital financing |

|

Trade services |

|

Leasing |

|

Cash management |

|

Deposit Products |

|

Mudarabah savings |

|

Mudarabah term investments |

|

Wakala investments |

OUTLOOK

As a part of the Bank’s growth strategy for 2020, NDB Shareek will continue to pursue synergies arising from NDB’s extensive network of SME and middle market enterprises as well as large local corporates and projects. Over the long-term we also hope to set up regional officers, to expand our reach across the island and serve the growing demand by providing need-based solutions and Islamic Banking cells into selected customer centres.

TREASURY