ABOUT THE BANK

An

impactful

bank

The NDB Group is uniquely positioned within Sri Lanka’s financial sector as the only banking institution in the country offering the full spectrum of banking and capital market solutions. NDB is a licensed commercial bank and the largest entity within the Group as the parent company, contributing to the majority of consolidated earnings. Commencing operations in 1979 as a development bank, NDB gradually widened the scope of its operations to emerge as a fully-fledged commercial bank by venturing into retail, SME and corporate banking while sustaining its competitive edge in project and development financing. The Bank serves a large customer base comprising individuals and institutions through a network of 107 branches in 22 districts and is powered by a team of over 2,000 employees.

In addition to banking services, the Group provides an array of capital market solutions including investment banking, wealth management, stock broking and private equity among others through its capital market cluster. Whilst a substantial part of the Group’s operations is in Sri Lanka, we also engage in fee-based business in Bangladesh through NDB Capital Limited and private equity in Mauritius through NDB Zephyr Partners Limited. The Bank, along with its capital market cluster companies is a frequent recipient of domestic, regional and international awards across a broad spectrum of performance aspects. The Bank also has a subsidiary company, engaged in property management.

NDB is listed on the Main Board of the Colombo Stock Exchange, with a recorded market capitalization of LKR 23.4 billion as of 31st December 2017. The Bank holds a credit rating of A+(LKA) with a Stable Outlook from Fitch Ratings Lanka Limited.

CREDIT RATING

A+

(lka)/Stable Outlook by Fitch Ratings Lanka Limited

As affirmed in December 2017

TOTAL ASSETS

383LKR billion

Solid growth recorded in the total Balance Sheet size ahead of the industry growth

Recipient of nearly 40 awards and titles, with several defended for consecutive years

A network of 107 branches supplemented by 122 ATMs, reaching out to a broad base of customers across the country

GROUP STRUCTURE

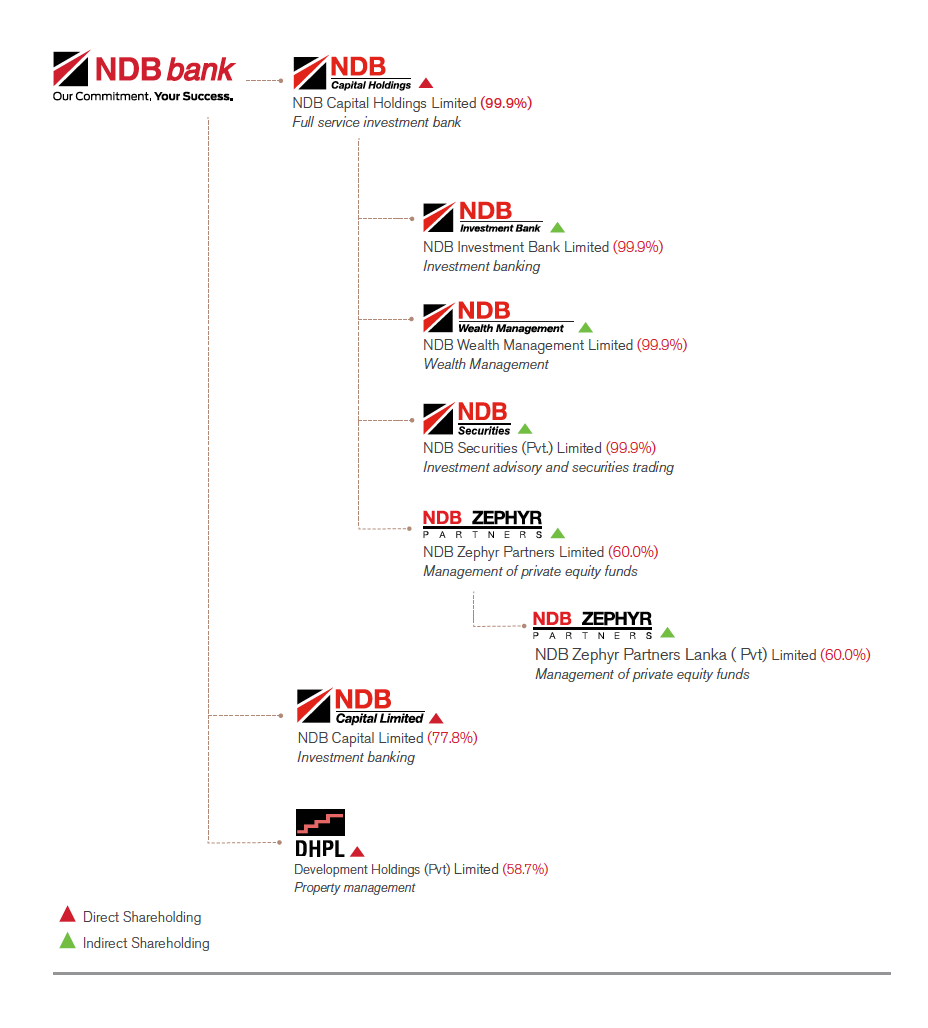

The Group’s capital market solutions are offered through dedicated subsidiaries as illustrated below. NDB Capital Limited is domiciled in Bangladesh while NDB Zephyr Partners was set up in Mauritius in partnership with the US-based Zephyr Management LP.

In addition to the above, the Bank also carries a direct holding of 50% in the form of associate companies, in NDB Venture Investment (Pvt) Limited and Ayojana Fund ( Pvt) Limited, both of which are venture capital businesses. These companies are presently under liquidation.

SNAPSHOT OF NDB BANK AND GROUP

A robust Group structure combining commercial banking, capital market services & property management

A total Group asset base of LKR 389 billion

Profit attributable to shareholders of LKR 3.5 billion ( 2016 : LKR 2.7 billion)