FINANCIAL HIGHLIGHTS 2017

|

Bank |

Group |

||||

|

2017 |

2016 |

Change |

2017 |

2016 |

Change |

|

LKR ‘000 |

LKR ‘000 |

% |

LKR ‘000 |

LKR ‘000 |

% |

Operating results for the year |

|

|

|

|

|

|

Gross income |

42,520,594 |

33,281,736 |

28 |

43,017,759 |

33,776,905 |

27 |

Operating profit before tax on financial services |

7,547,420 |

5,335,004 |

41 |

7,191,740 |

5,093,546 |

41 |

Taxation |

3,195,791 |

2,164,733 |

48 |

3,759,437 |

2,278,587 |

65 |

Profit for the year |

4,351,629 |

3,170,271 |

37 |

3,432,303 |

2,814,959 |

22 |

Profit attributable to equity holders of the parent |

4,351,629 |

3,170,271 |

37 |

3,489,752 |

2,691,014 |

30 |

Gross dividends for the year |

1,543,371 |

1,321,484 |

17 |

1,543,371 |

1,321,484 |

17 |

Revenue to government |

3,145,376 |

2,081,000 |

51 |

3,264,294 |

2,233,854 |

46 |

Assets and liabilities |

|

|

|

|

|

|

Due to other Customers |

273,369,023 |

203,866,547 |

34 |

273,041,417 |

203,515,828 |

34 |

Loans and receivables |

274,029,448 |

227,676,876 |

20 |

274,078,788 |

227,716,971 |

20 |

Total assets |

383,073,042 |

334,544,735 |

15 |

388,645,438 |

340,731,768 |

14 |

Total liabilities |

354,335,207 |

309,799,685 |

14 |

354,667,465 |

309,718,472 |

15 |

Total equity to equity holders of the Bank |

28,737,835 |

24,745,050 |

16 |

33,012,227 |

29,936,587 |

10 |

Profitability (%) |

|

|

|

|

|

|

Net interest margin |

3.00 |

2.64 |

13 |

3.04 |

2.70 |

13 |

Non-performing loans ratio |

1.83 |

2.63 |

(30) |

1.83 |

2.63 |

(30) |

Return on assets |

1.21 |

0.99 |

23 |

0.96 |

0.82 |

17 |

Return on equity |

16.27 |

13.36 |

22 |

11.09 |

9.23 |

20 |

Total leverage (times) |

13.33 |

13.52 |

(1) |

11.77 |

11.38 |

3 |

Cost to income ratio |

45.48 |

49.04 |

(7) |

49.16 |

52.34 |

(6) |

Investor information (LKR) |

|

|

|

|

|

|

Net asset value per share |

167.58 |

149.80 |

12 |

192.51 |

181.23 |

6 |

Market value per share - as at 31 December |

136.40 |

156.00 |

(13) |

NA |

NA |

- |

Earnings per share - basic/diluted |

25.38 |

18.49 |

37 |

20.35 |

15.69 |

30 |

Price earnings (times) |

5.37 |

8.44 |

(36) |

NA |

NA |

- |

Dividend per share |

9.00 |

8.00 |

13 |

NA |

NA |

- |

Dividend cover (times) |

2.82 |

2.31 |

22 |

NA |

NA |

- |

Dividend yield (%) |

6.60 |

5.13 |

29 |

NA |

NA |

- |

Market capitalization (LKR' 000) |

23,390,650 |

25,768,939 |

(9) |

NA |

NA |

- |

Regulatory ratios (%) |

|

|

|

|

|

|

Capital adequacy ratios* |

|

|

|

|

|

|

Common Equity Tier 1 Capital Ratio |

8.85 |

N/A |

- |

10.49 |

N/A |

- |

Tier 1 Capital Ratio (Minimum Requirement - 7.25%) |

8.85 |

9.31 |

(5) |

10.49 |

11.55 |

(9) |

Total Capital Ratio (Minimum Requirement - 11.25%) |

13.89 |

12.95 |

7 |

15.18 |

15.27 |

(1) |

Statutory liquid assets ratio (%) |

||||||

DBU (Minimum Requirement - 20%) |

22.13 |

21.50 |

3 |

N/A |

N/A |

- |

FCBU (Minimum Requirement - 20%) |

24.01 |

22.93 |

5 |

N/A |

N/A |

- |

Liquidity coverage ratio (%) |

|

|

|

|

|

|

Rupee (Minimum Requirement - 80%) |

214.35 |

142.53 |

50 |

N/A |

N/A |

- |

All Currency (Minimum Requirement - 80%) |

154.50 |

125.63 |

23 |

N/A |

N/A |

- |

* Capital adequacy ratios for 2016 are stated in accordance with the Basel II guidelines.

Financial goals and achievements

|

Goals |

Achievements |

||||

2017 |

2016 |

2015 |

2014* |

2013* |

||

Financial indicators - Bank |

||||||

Return on Assets (%) |

Over 1.5% |

1.21 |

0.99 |

1.23 |

1.47 |

1.14 |

Return on equity (%) |

Over 17% |

16.27 |

13.36 |

15.63 |

16.33 |

14.38 |

Growth in total operating income (%) |

Over 20% |

22.82 |

7.71 |

4.69 |

19.00 |

11.55 |

Growth in profit after taxation (%) |

Over 20% |

37.26 |

(9.72) |

2.73 |

64.00 |

(29.00) |

Growth in total assets (%) |

Over 15% |

14.51 |

8.21 |

17.67 |

31.00 |

23.00 |

Dividend per share (LKR) |

LKR 8 Per Share |

9.00 |

8.00 |

11.00 |

11.00 |

10.00 |

Capital adequacy ratios: |

||||||

Common Equity Tier 1 Capital Ratio - (Minimum Requirement - 5.75%) |

Over 8% |

8.85 |

NA |

NA |

NA |

NA |

Total Tier 1 Capital Ratio - (Minimum requirement - 7.25%) |

Over 8% |

8.85 |

9.31 |

8.51 |

10.09 |

12.05 |

Total Capital Ratio - (Minimum requirement - 11.25%) |

Over 12% |

13.89 |

12.95 |

12.59 |

14.68 |

17.87 |

* The above achievements are presented excluding the one-off equity income of LKR 6,031 million for the year 2013.

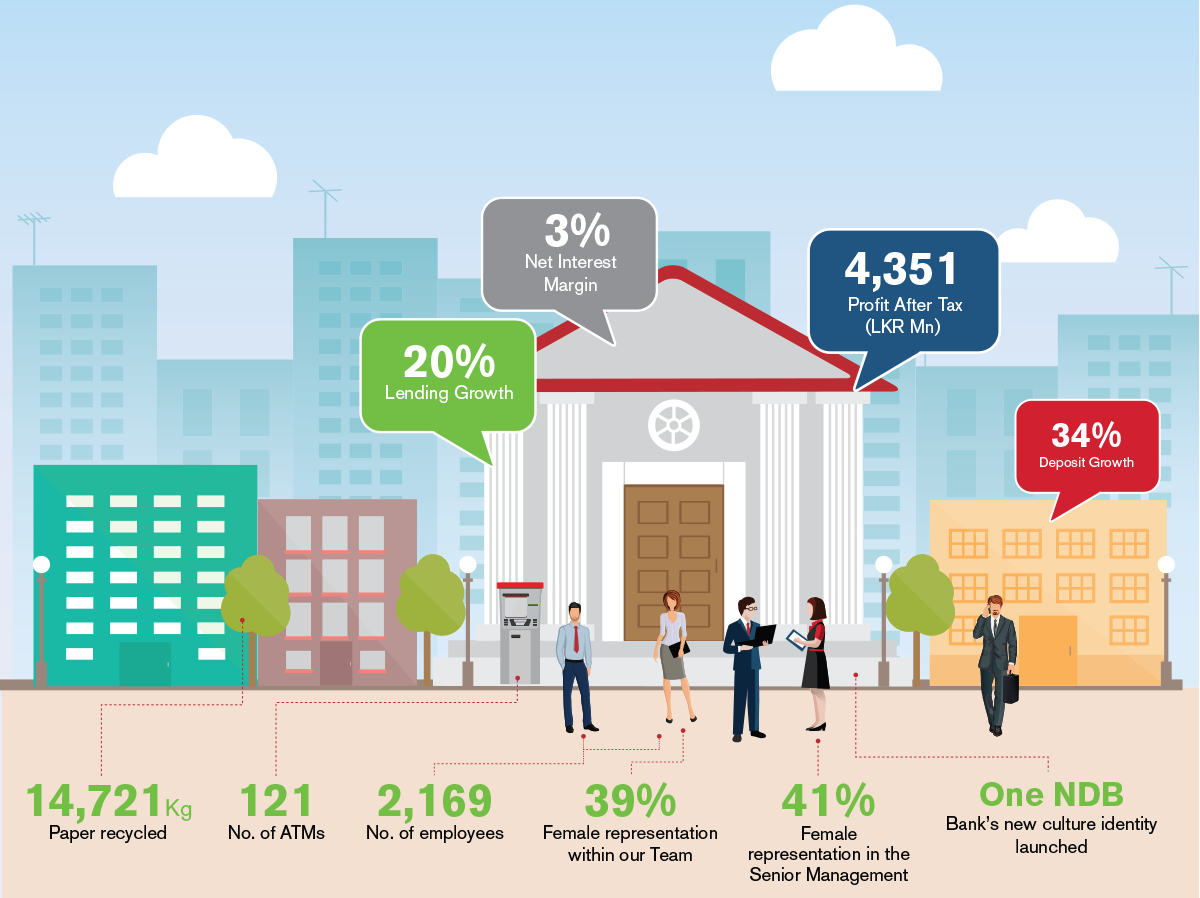

PERFORMANCE HIGHLIGHTS 2017

2017 |

2016 |

Change (%) |

|||

Human Capital |

No. of employees |

2,169 |

2,109 |

2.84 |

|

New recruits |

423 |

445 |

-5 |

||

Turnover rate (%) |

9.3 |

6.6 |

- |

||

Female representation-overall (%) |

39 |

39 |

- |

||

Female representation-senior management (%) |

41 |

41 |

- |

||

Payments to employees (LKR million) |

3,611 |

3,435 |

5 |

||

Workplace injuries |

0 |

1 |

- |

||

Revenue per employee (LKR million) |

7.45 |

6.24 |

19 |

||

Profit before tax per employee (LKR million) |

3.48 |

3.06 |

14 |

||

Social and Relationship Capital |

Funds Disbursed to SME and Micro (LKR million) |

44.47 |

39.85 |

11.5 |

|

SME and Micro Finance lending outside the Western province (%) |

48 |

48 |

- |

||

Correspondent Relationships |

94 |

94 |

- |

||

Incidents of non-compliance with laws and regulations (No. of) |

0 |

0 |

- |

||

Payments to suppliers (LKR million) |

3,029 |

2,339 |

29 |

||

Manufactured Capital |

Capital expenditure (LKR million) |

588 |

871 |

-32 |

|

No. of branches |

107 |

104 |

- |

||

No. of ATMs |

121 |

115 |

- |

||

New branches opened during the year |

3 |

11 |

- |

||

Natural Capital |

Electricity consumption (kwH) |

5,864,560 |

5,864,988 |

- |

|

Paper consumption (kg) |

49,493 |

46,017 |

8 |

||

Paper recycled (%) |

30 |

48 |

- |