EMERGING INDUSTRY TRENDS

Our strategy formulation process follows an assessment of emerging trends in the operating landscape which could present opportunities for growth or adversely impact our ability to create value in the long-term. Accordingly, our strategy positions us to capitalize on these trends while ensuring that the requisite governance and risk management structures are in place to minimize the impacts of emerging risks.

MACRO-ECONOMIC CONDITIONS

Sri Lanka’s economic growth was moderate in 2017, with GDP expanding by 3.7% in the 9 months to September. The agriculture sector was, affected by adverse weather conditions while the industry and services sectors expanded by 4.5% and 4.2% respectively. Services sector growth was supported by financial services, wholesale and retail trade activities and transportation (Refer to page 39 for further information).

The medium to long-term economic outlook for Sri Lanka remains positive as reforms targeted towards bridging the fiscal deficit, stabilizing macro-economic fundamentals and attracting foreign investment are expected to accelerate the pace of economic growth. It is encouraging that reforms required to place the economy on a higher trajectory of growth have commenced.

INCREASING CONNECTIVITY

Sri Lanka’s internet subscribers have more than tripled over the past 3 years and mobile penetration is more than 100%, attesting to the increased connectivity and digital literacy in Sri Lankan households. The digital revolution and disruptive technologies in financial services is transforming the way banks interact with their customers. Banks which are well equipped to innovate and embrace the digital frontier are thus positioned to benefit from increasing connectivity by offering multi-channel solutions, more reliable back-end processes, an increasingly productive workforce and optimization of business and operational models. Digital capabilities will thus be crucial in establishing an agile customer interaction model which keeps pace with customer expectations and drives differentiated value.

KEY TRENDS

Macro-economic conditions

Increasing connectivity

Increased regulations

Demographic changes

Social and environmental consciousness

Opportunities Presented by the Digital Transformation

INNOVATION

Multi-channel banking

Sales and service transformation

Enhanced accessibility

INNOVATION

Information based businesses

Mobile payments

Virtual delivery

INTERNAL EFFICIENCIES

Cost reduction

Improve turnaround and processing times

More effective risk management

EMPLOYEE PRODUCTIVITY

Free employee time to pursue business expansion and enhance customer relations

Offer flexible/virtual working solutions

Support employee satisfaction and retention

INCREASED REGULATORY DEMANDS ON GOVERNANCE AND RISK MANAGEMENT

Globally and domestically there has been an onset of increased financial sector regulation to ensure stability and soundness of banks and other financial institutions. The CBSL’s approach has centered on establishing sound risk management systems, instilling good corporate governance practices, strengthening capital buffers and promoting financial inclusion. Increased regulation can at times result in greater complexity and higher compliance costs for financial institutions, some of which may impact customers through pass-on effects.

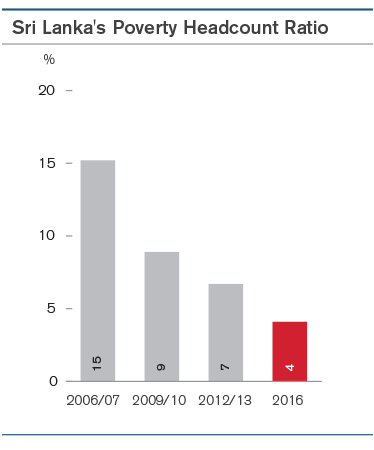

DEMOGRAPHIC CHANGES

Demographic changes such as a growing middle class and an ageing population have significant implications for the banking sector. Incidence of poverty in Sri Lanka has continued to decline and the expansion of the middle class has resulted in shifting consumption patterns, with higher spending towards white goods, education, housing and healthcare. These shifts present opportunities for financial institutions to develop innovative product offerings to cater to emerging prospects.

EMPHASIS ON SOCIAL AND ENVIRONMENTAL SUSTAINABILITY

The rapid industrial and economic growth over the past two decades have come at a significant environmental cost and there is now mounting evidence to show that human consumption patterns could substantially affect the planet’s sustainability. The impacts of climate change have been felt increasingly across the globe, with erratic weather patterns, rising temperature and energy constraints impacting economic growth in several regions. On the other hand, millions of citizens around the world still lack access to employment opportunities, affordable housing, transportation, education and healthcare. Addressing these issues of social and environmental sustainability have emerged as a global priority and all organizations including banks have a role to play in driving sustainable economic, social and environmental progress. In addition to minimizing their own environmental impacts, banks play a vital role in supporting environmentally and socially responsible initiatives through their lending practices; these include lending towards renewable energy, green technology, women empowerment and rural development, among others.

Source: Dept. of Census and Statistics

Source: Dept. of Census and Statistics

An important component of the Bank’s sustainability agenda also includes the Bank’s indirect environmental impact. As a Bank we ensure that our indirect impacts are minimized or removed. The Bank's sustainability policy ensures that the Bank’s responsibilities also extend to the wider operations of the Bank. For example: refusing to lend to businesses whose actions cause unacceptable harm to the environment, or by insisting that key suppliers adhere to prescribed sustainability standards. Internal awareness raising is carried out regularly to educate and encourage employees to minimize waste and optimize resources. Furthermore, capacity building in environmentally sustainable behaviour and practices, is conducted for customers and potential customers of the Bank.